best tax saving strategies for high income earners

This is an important. Invest in tax-exempt bonds.

Tax Advantaged Savings Accounts For High Income Earners Paces Ferry Wealth Advisors

June 26 2022 Investing Taxes.

. Thankfully there are things you can. High-income earners should consider investing in municipal bonds. They borrow cash in exchange for fixed payments.

When you donate to charity you enjoy the privilege of a tax deduction in the year the. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Tax Strategies for High Earners.

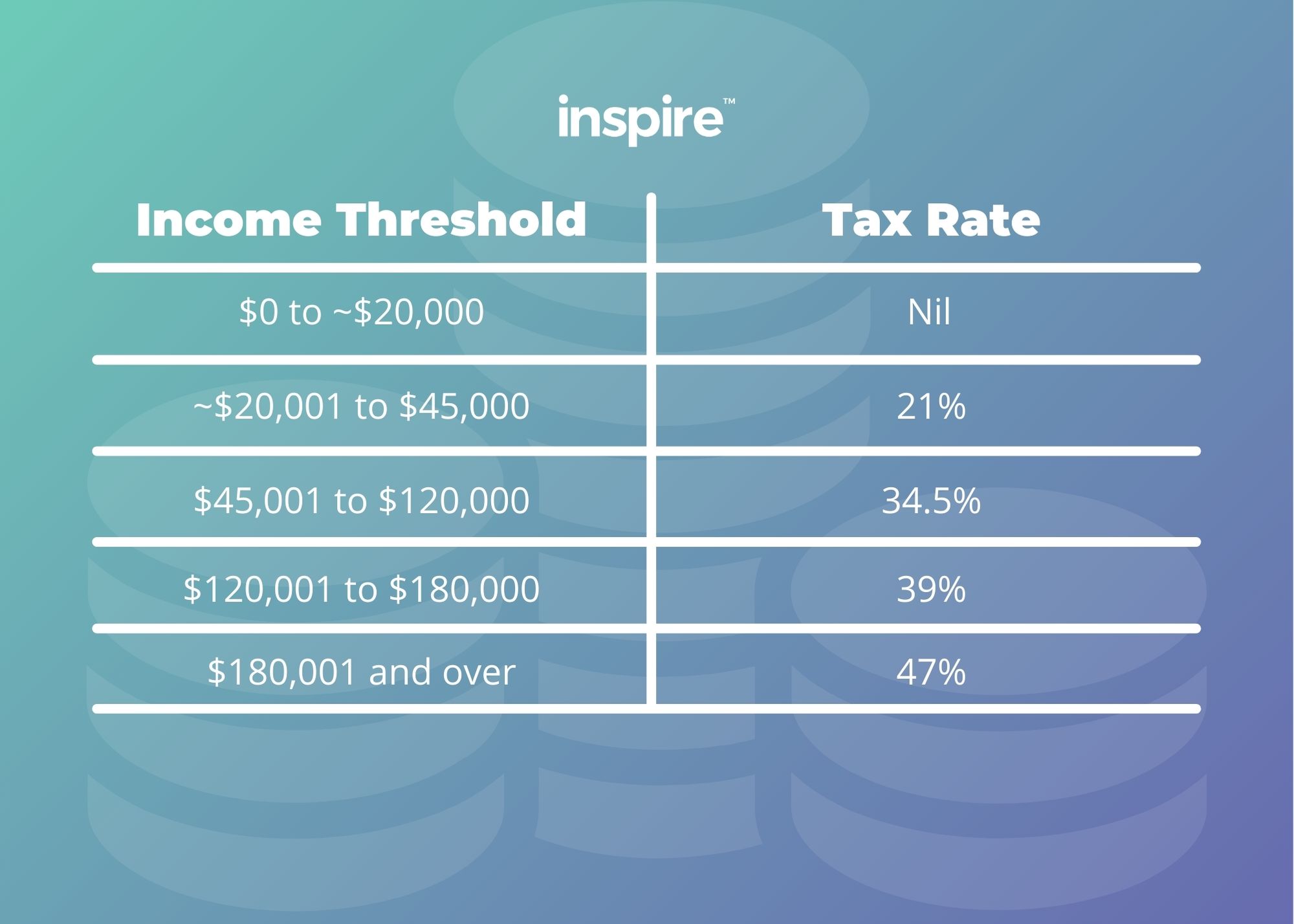

In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege. Max Out Your Retirement Account. If you earn a high income here are tax saving strategies that will help you keep more of your hard earned cash.

Donating to charity is one of the smartest tax-saving strategies for high-income earners. While you wont work tax-free with a C corporation you would still pay. Trusts can also help reduce your state income tax liability on investment earnings so while the Federal tax rate stays the same there are savings on state taxes.

This is a tax-effective strategy because super contributions. Converting some of your retirement account funds to a Roth is one of the most counter-intuitive tax strategies for high-income earners on this list. Any interest you earn is not subject to federal income tax and Medicare surtax calculations.

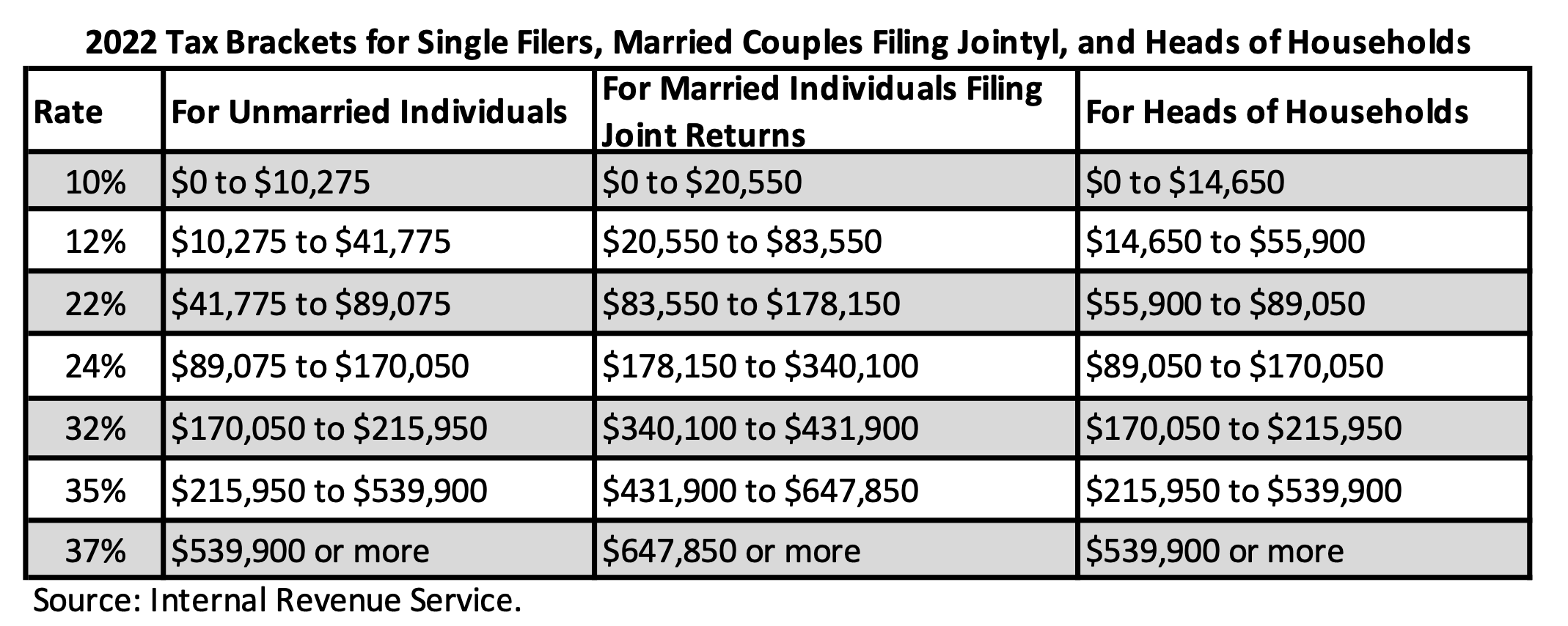

Take advantage of vehicles for future tax-free income. Also municipal bond interest for bonds purchased in the. The Tax Cuts and Jobs Act TCJA signed into law December 2017 and implemented in 2018 is currently set to sunset after 2025.

You must however be. Second the yearly loss is typically compensable by other income. For instance the.

However the tax benefits. Bonds mature with an initial return for the buyer. As shown below deductions nearly.

Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead. This is actually one of the best tax reduction strategies for high-income earners as it brings you to a financial advantage. The good news is that there are numerous tax-reduction techniques available for high-income taxpayers if you happen to be in the higher tax bracket.

Preparing a strategy that is tax-efficient might feel daunting at first. According to the ATO youre classified as a higher income earner if you earn over 180000 a year. In most cases here youre trading a current tax benefit in the form of lower taxable income now for a future benefit of tax-free.

Family Income Splitting and Family Trusts. Theres no doubt that everyone. Because it allows you to take current and future year.

Invest in Your Childrens Education. 4 Tax-Efficient Investing Strategies for High Earners. There are a few tax strategies for high income earners that will help you save thousands or more on your taxes.

Using a donor-advised fund DAF is probably one of the best tax strategies for high income earners. First a property with a good location may appreciate in value through time resulting in a capital appreciation. Tax laws change often and.

Tax laws change often and increasing complexity makes it hard to stay on top of the latest tax saving strategies for high income earners.

Tax Reduction Strategies For High Income Earners Pure Financial

Tax Saving Strategies For High Income Earners Smartasset

The 4 Tax Strategies For High Income Earners You Should Bookmark

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

Tax Saving Strategies For High Income Earners Smartasset

The Top 9 Tax Planning Strategies For High Income Employees Inspire Accountants Small Business Accountants Brisbane

The 4 Tax Strategies For High Income Earners You Should Bookmark

Important Tax Savings Strategies For The Affluent And Those Who Want To Be

Tax Reduction Strategies For Executives And High Income Earners 2022 Podcast Kathmere Capital Management

5 Tax Strategies For High Income Earners Pillarwm

High Income Tax Planning Strategies Wade Financial Advisors

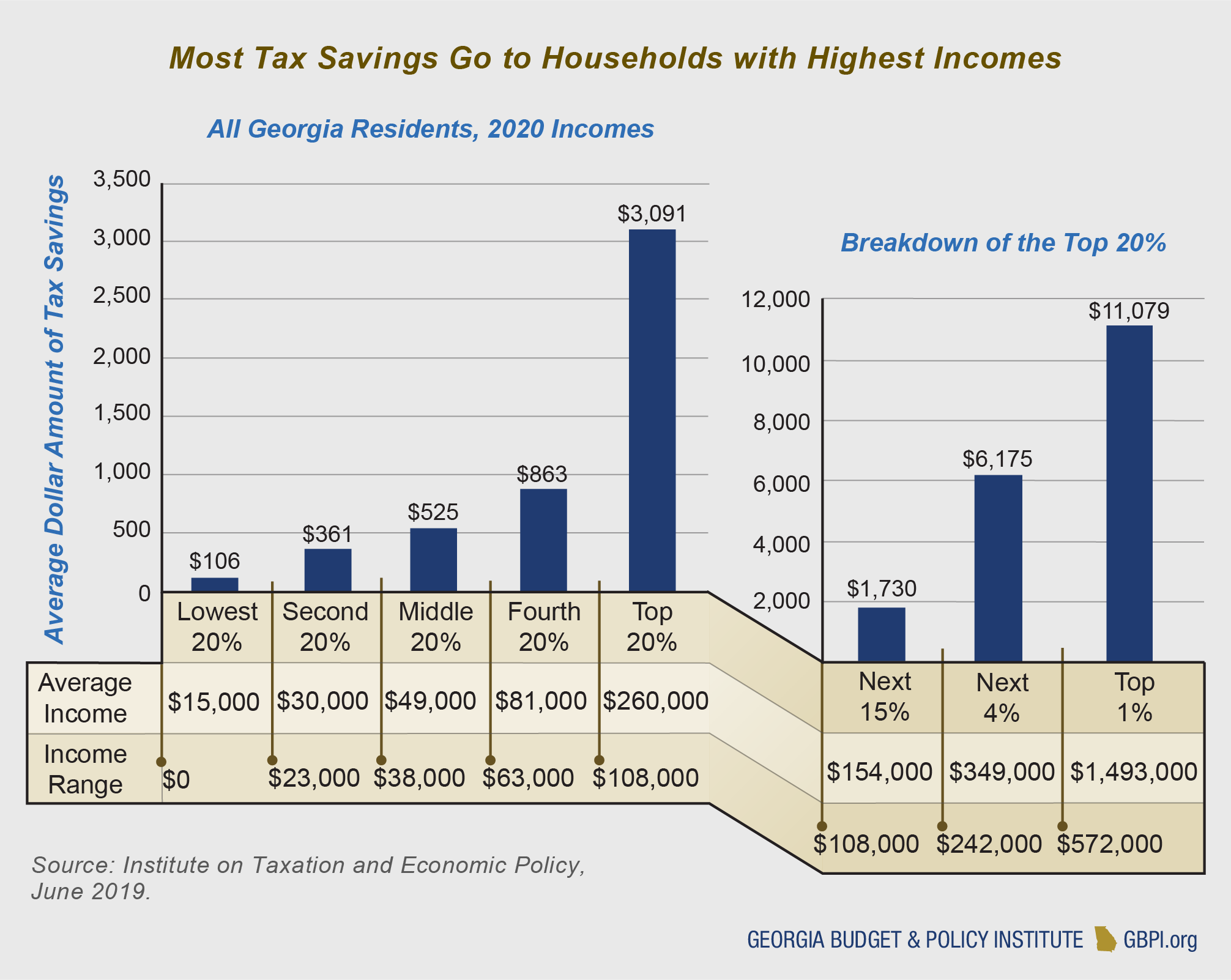

The Tax Cuts And Jobs Act In Georgia High Income Households Receive Greatest Benefits Georgia Budget And Policy Institute

:max_bytes(150000):strip_icc()/Term-Definitions_backdoor-roth-ira-ef8e60bcd8a84c80ae9bc8d4f05bd04d.png)

Backdoor Roth Ira Advantages And Tax Implications Explained

5 Outstanding Tax Strategies For High Income Earners

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

5 Tax Deductions For High Earners Plus A Tax Hack The Physician Philosopher

10 Tax Planning Strategies For High Income Earners Gamburgcpa

Tax Strategies For High Income Earners Taxry

Strategies To Preserve Salt Deductions For High Income Taxpayers